With the increase in identity theft and hacking of personal accounts, it becomes increasingly difficult for companies to trust that someone is who they claim to be in an online system.

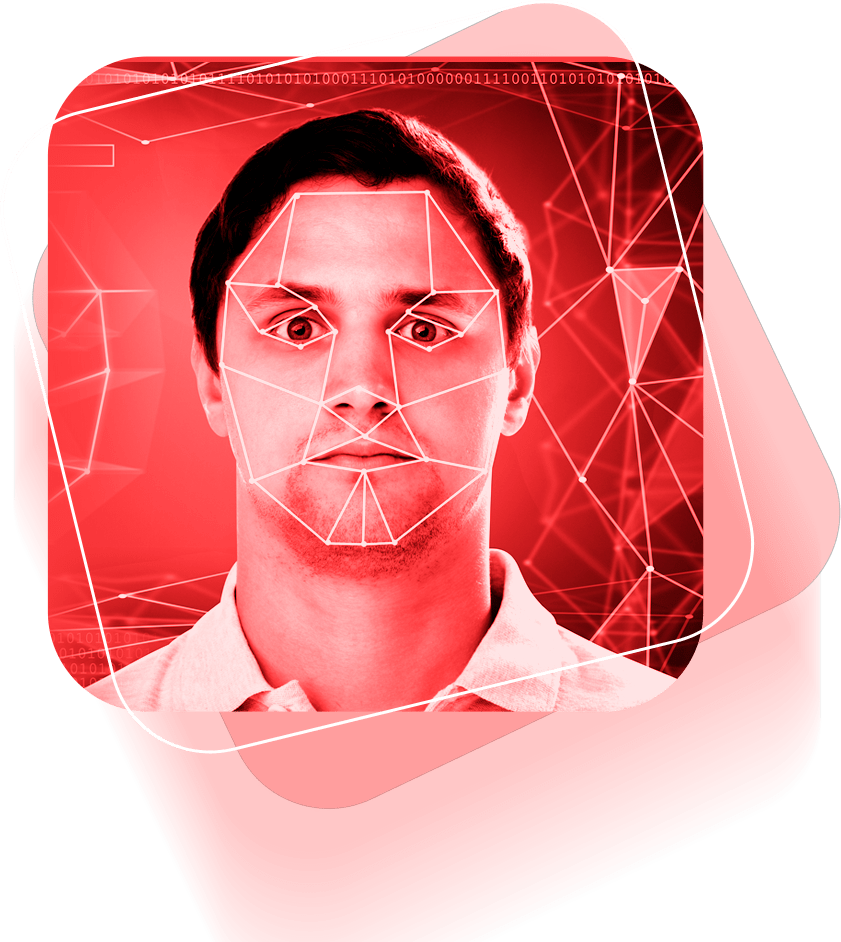

Our identity verification and eKYC solutions leverage biometrics, AI, and the latest technologies to quickly and automatically verify the digital identities of new and existing users, assessing risks and meeting compliance obligations.

Make sure that your online customers are

who they say they are.

Our solutions validate user identification, confirm with a selfie, and use advanced liveness detection to ensure the person is actually present.

Biometrics-based authentication ensures that the returning user is the same person admitted at registration.

The flexible onboarding cycle supports over 5,000 identification types in over 200 countries and territories and can be integrated with existing applications and workflows via mobile or web.

Our solutions have unparalleled global coverage, scale and data network size. They are able to leverage industry-leading machine learning and artificial intelligence more intelligently to help detect and stop fraud and financial crime faster, while minimizing bias and delivering the highest accuracy.

• More than one billion transactions worldwide;

• Intelligent algorithms powered by verification experts;

• Bank-grade security certified by ISO/IEC 27001:2013, PCI DSS and SOC2 type 2.

• Allow your online customer to scan documents (proof of residence, utility bill, credit card statement, and others) in seconds using a smartphone camera;

• Capture proof of identity and address to meet KYC and KYB requirements as required in many jurisdictions;

• Our computer vision, AI, and automation technology combine to provide 100% extraction accuracy, even when documents are crumpled.